When ling form C-9600, be aware of the following:

• The purchaser must give notice to the Division of Taxation about a

pending sale/transfer/assignment of business assets sold/transferred/

assigned other than in the ordinary course of business in order to insulate

them from inheriting any and all seller’s taxes that may be due to the

Division of Taxation.

• The buyer or their attorney must send a completed Form C-9600 with

an executed copy of the contract of sale, including any amendments,

revisions, or assignments. The Division must receive these at least 10

business days prior to the sale/transfer/assignment of the business assets.

• If the business is unregistered or if there is missing or incomplete

information, there may be a delay in response time.

• All submissions must use overnight, certied, or registered mail. This

will be your only proof of delivery. Hand deliveries are not acceptable.

Applications received by the Division of Taxation after 11:59 a.m. are

considered received the following business day.

• The Division will not respond to status inquiries until 10 business days

after receipt.

• There is no expedited service available.

• All responses use the U.S. Postal Service. Please allow ample time for

mail delivery of our response to your request. We do not email or fax

responses.

• Liquor license transfer certicates are issued by our License Verication

unit and are not subject to the 10 business day time frame. The License

Verication unit’s email address is [email protected] for

questions only.

For additional information, see our Frequently Asked Questions (FAQ) page

located at https://www.nj.gov/treasury/taxation/faqbulksale.shtml.

If you still have questions after reading our FAQ, you may email your bulk

sale-related questions to [email protected]. This mail box is only for

questions and is not to be used for submissions.

(This page does not have to be sent with the C-9600)

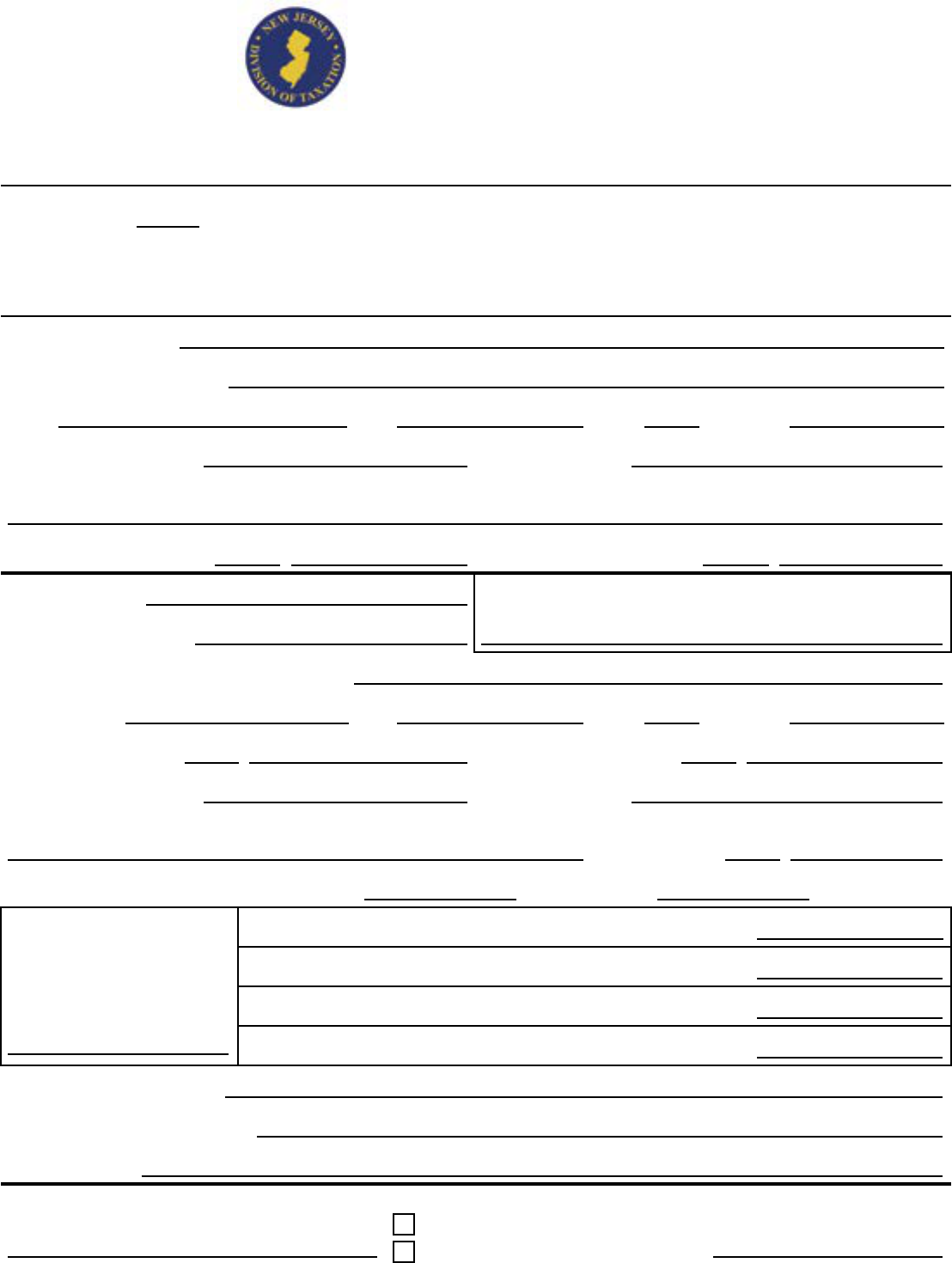

C-9600

09-21

Overnight Carriers:

Bulk Sale Section

3 John Fitch Way 5th Floor

Trenton NJ 08611

State of New Jersey

Department of the Treasury

Division of Taxation

Mailing Address:

Bulk Sale Section

PO Box 245

Trenton, NJ 08695-0245

Notication of Sale, Transfer, or Assignment in Bulk

Attach Executed Copy of Pending Contract of Sale or Transfer

This form is to be used by the purchaser/transferee to notify the Director of the Division of Taxation of any bulk transfer in

accordance with N.J.S.A. 54:50-38.

By statute, the following information is required to be submitted by registered mail 10 business days before taking

possession of, or paying for, the property.

Certied Mail or Overnight Delivery is also acceptable. Hand Deliveries are not acceptable

Name of Purchaser(s)

Trade Name of Purchaser(s)

Street City State ZIP Code

Federal Identication No. Social Security No.

Name and Mailing Address of Attorney for Purchaser

Attorney’s Phone Number ( ) Purchaser’s Phone Number ( )

Name of Seller(s)

Seller’s Liquor License No. (If Applicable)

Trade Name of Seller(s)

Name of Ocer, Partner, or Individual Owner

Home Address City State ZIP Code

Home Phone Number ( ) Business Phone Number ( )

Federal Identication No. Social Security No.

Name and Mailing Address of Attorney for Seller

Phone Number ( )

Date Seller Acquired Business: Month Year

Scheduled Date of Sale

Must be at least 10 business

days after our receipt.

Sales Price of Furniture, Fixtures, and Equipment .........................$

Sales Price of Land and Building....................................................$

Sales Price of Other Assets (attach schedule) ...............................$

Total Sales Price .............................................................................$

Terms and conditions of sale

Location of business or property

Type of business

Signature Check one:

Purchaser/Transferee

Attorney for Purchaser/Transferee

Date